Officials face the future with new office building in Crestview

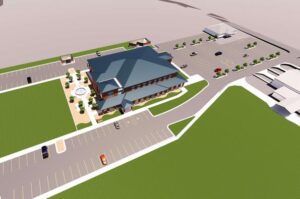

The more than $14.5 million facility will stand on a 2.5-acre parcel at 1448 Commerce Drive, west of the Crestview Area Chamber of Commerce office. Construction could be completed in late fall of 2026.

The demand for services provided by the tax collector, property appraiser and other government functions at the county owned Brackin Building on North Wilson Street in Crestview has grown to the point where it is appropriate to develop new offices, according to county information.

“As we all know, the north end of the county has had extraordinary growth, and the future is even brighter than what we’ve had,” Anderson said. “And we’re very excited to expand our offices to fill the needs, and with this new facility that (the Tax Collector’s Office is) building in partnership with the county, we anticipate bringing our call and processing center to the north end of the county (from Niceville), and we’re also going to expand our branch services and lobby area in order to handle the customers.

He added, “We’re not building just for today’s needs: We’re looking to the future. On behalf of the county, were’ going to have space (in the new building) for them to expand, and also we have another (adjacent) site that will be able to bring administrative government services to the north end.”

Besides standing next to the Chamber of Commerce office, the new facility will be adjacent to the Crestview Community Center and Crestview Public Library.

County staff is considering future uses of the current tax collector and property appraiser spaces within the Brackin Building once they’re vacated.

The new office building represents “a solid indication of the cooperation between the county and the city of Crestview as we all strive, working together, to meet the needs of the citizens in the north end of this county,” Anderson said.

Bear General Contractors, LLC, of Pensacola, will build the new structure. County officials are using bond money to pay for the construction cost, with repayment coming from annual reimbursements from the Tax Collector’s Office.

“This is really an exciting opportunity to see the tax collector expand services to our constituents,” District 4 County Commissioner Trey Goodwin, who is the commissioner liaison to the tax collector, said during the ceremony. “Thank you all for showing up on this toasty July morning to celebrate what’s really going to be an excellent opportunity for the constituents of Okaloosa County, because that’s really what this is about.”

District 1 County Commissioner and Commission Chairman Paul Mixon was unable to attend the ceremony.