Bids approved for city engineering and pest control services

CRESTVIEW — The City Council has unanimously accepted two requests from the Public Works Department to cover engineering and pest control services.

Assistant Public Works director Carlos Jones — representing director Wayne Steele, who was out on medical leave — said Monday that they received plenty of response on a request for proposals for engineering consultants.

“We had nine firms that responded to that RFP,” Jones said during the city council meeting.

Jones said given the responding firms' diversity, the review committee revised the proposal's scope, selecting four firms that represented a cross section of areas of expertise.

“Several firms were needed to meet the planning and engineering needs of the city,” city engineer Fred Cook stated in a letter to the council.

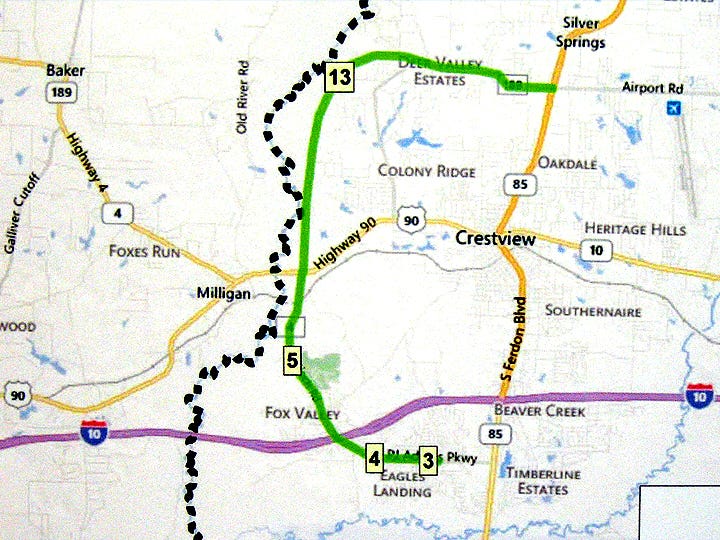

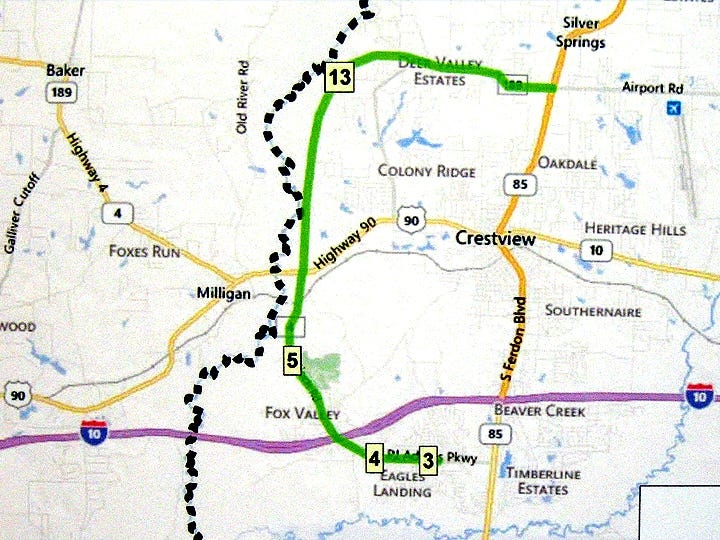

CH2MHill, PolyEngineering, Seaside Engineering and Survey, and Atkins North America, will cover engineering needs such as upgrades to Twin Hills Park, water systems, sewer systems, drainage and erosion control, and roads and traffic.

“We also felt that utilizing four firms would provide more options to the city in the event that one is not able to provide the services at the time needed,” Cook’s letter stated.

With the council’s approval, Public Works will negotiate hourly rates with the four firms and prepare four respective continuing services contracts for the council’s approval. The city will only pay the firms when engineering services are actually needed.

PEST CONTROL

For pest control services, Bryan Pest Control was the only bidder to respond to Public Works’ request for proposals, Jones stated.

Its initial bid was outside the budgeted amount, but after negotiations, the company agreed to an annual cost of $3,960 to treat 15 city-owned facilities.

Bryan agreed to treat each building quarterly for $66 each, and would “take care of any problems between services at no charge,” according to a letter to the city from Allan Quigley, Bryan general manager.

A second company that planned to bid on pest control services submitted a proposal after the deadline, Jones said.

Email News Bulletin Staff Writer Brian Hughes, follow him on Twitter or call 850-682-6524.

This article originally appeared on Crestview News Bulletin: Bids approved for city engineering and pest control services