When an Okaloosa Property owner becomes delinquent on his property taxes, the government doesn’t step in and seize the land. But a neighbor might.

CRESTVIEW — For some of the estimated 3,500 to 4,000 Okaloosa County property owners who still owe their real estate taxes, help may come in the form of a neighbor who essentially pays the bill by buying a tax certificate.

The catch is, unless the property owner pays his bill within two years, that helpful neighbor can apply for a tax deed on the property and could conceivably obtain the land, or at least profit from its sale.

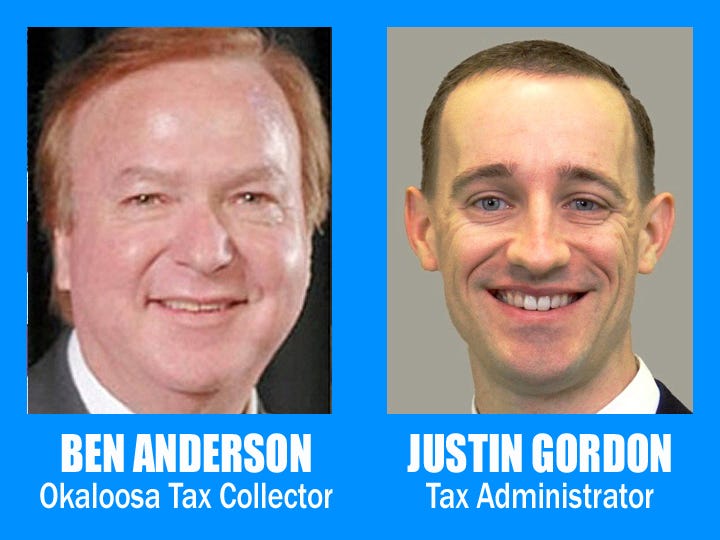

But that scenario is unlikely, Okaloosa County tax administrator Justin Gordon said.

“It’s not a great way to obtain property,” Gordon said. “It’s more of an investment opportunity, like an interest return on an investment. The majority of time the person who buys a certificate does not obtain property.”

HELPING NEIGHBORS

“It’s neighbors paying their neighbors’ unpaid taxes at an extra rate that they want to receive,” Okaloosa County Tax Collector Ben Anderson said.

Investors bid to buy tax certificates on unpaid property taxes, with the certificates going to the bidder who offers the lowest interest rate.

“It’s like a reserve auction that begins at 18 percent and can go all the way down to zero, but the average is 2.5 percent,” Anderson said.

“There’s a benefit in knowing the property owner in that it drives down the interest,” Gordon said. “The tax certificate gives the owner a little bit of time to get caught up on his taxes.”

But those helpful bidders aren’t always kindly neighbors giving a boost to the down-on-his-luck fellow next door. Florida has America’s most fertile tax certificate shopping grounds, Gordon said.

TAX CERTIFICATE HOTBED

“Florida is like the hotbed for tax certificate sales in the country,” he said. “The rules are some of the best around the country. Investment firms do it. That’s what people typically buy instead of a bond or a CD.”

But cash-squeezed local residents may be assured small tax amounts are not very attractive to big-time certificate investors, Gordon said. They’re after larger delinquencies for their portfolios, such as the $240,000 owed last year by an Okaloosa Island hotel owner.

“There’s a lot of competition on these certificates,” Gordon said, as opposed to small amounts. Last year some back taxes owed were as little as $30. The average is about $1,000, he said.

THE PAYOFF

For certificate tax holders, the payoff comes when the property owner, such as the guy who owned the hotel, pays off his tax debt, which can accumulate to include the taxes, interest due the county, interest due the certificate holder, penalties and expenses such as advertising the certificate sale on the property.

If the delinquent taxes aren’t forthcoming, after two years, the certificate holder can give the process a gentle nudge by applying for a tax deed, which the investor can use to force a sale of the property.

“The certificate owner uses the tax deed application method to try to get their investment back,” Gordon said. “That’s when the window of opportunity opens for that certificate owner to try to take that property to sell.”

But rarely does the property go on the market.

“Having that ability after two years during which their certificate has not been redeemed, that’s one way of trying to get their money out of it,” Gordon said. “Most of the time when that sale is pending, someone steps up and pays.”

But if they don’t, the deed can be sold at public auction, and the certificate holder can recoup some if not all of his investment.

If after seven years the certificate holder doesn’t apply for a tax deed, and the property owner still hasn’t paid delinquent taxes, the certificate expires and the investor is out his investment.

Okaloosa County, however, still receives its taxes due on the property.

FINANCING GOVERNMENT

The tax certificate program is mandated by the state Legislature, Anderson said, and is a means to assure local taxing authorities receive their budgeted funding.

“Property taxes are the local tax that helps the government operate,” he said. “It provides the services to the citizens of their tax jurisdiction. Our job is to collect the tax to provide the funds to the taxing authorities in order to provide the services expected by the taxpayers.”

In 2014, Anderson’s office issued tax bills for about $207 million and collected it all but $16,000. Tax certificate sales covered that balance.

“The good side of that is all the local governments continued to operate and provide services,” Anderson said. “For those who can’t pay in a timely manner, others step in and make sure we receive the funds for governments to operate.”

In 2013, Okaloosa County was the state’s only county to collect 100 percent of its taxes. This year, Gordon said, about 3,500 to 4,000 properties will wind up on the tax certificate sale list down from 4,300 last year.

“People can pay off their tax and be removed from that list between now and June 1,” Gordon said. “We’re looking at taking less this year, so that means people have been paying their taxes.”

Real estate taxes become delinquent if not paid before April 1. Beginning on or before June 1, the Okaloosa County Tax Collector is required by law to hold a tax certificate sale. The certificates represent liens on all unpaid real estate properties. The sale allows citizens to buy certificates by paying off the owed tax debt.

A tax certificate, when purchased, becomes an enforceable first lien against the real estate. The certificate holder is actually paying the taxes for a property owner in exchange for a return on his investment.

In order to remove the lien, the property owner must pay the tax collector all delinquent taxes plus accrued interest, penalties and advertising fees. The tax collector then notifies the certificate holder of any certificates redeemed and a refund check is issued to the certificate holder.

A tax certificate is valid for seven years. The holder may apply for a tax deed after two years. If the property owner fails to pay the tax debt, the property tax deed is sold at public auction.

Source: Okaloosa County Tax Collector’s Office

TAX CERTIFICATE WORKSHOPS, DEADLINES

Investors interested in buying tax certificates — or just helping a neighbor whose taxes are delinquent — can attend one of these public workshops to learn more about bidding on certificates.

●May 12, 6 p.m., 1250 N. Eglin Parkway, Suite 101, Shalimar

●May 17, 6 p.m., 701 John Sims Parkway, Niceville

●May 19, 6 p.m., Crestview, Brackin Building, 302 North Wilson St., Suite 101

●May 24, 6 p.m., 1250 N. Eglin Parkway, Suite 101, Shalimar

Tax Certificate Bidding

Online bidding is at www.bidokaloosa.com

Opens: May 11

Closes: 8 a.m. June 1: winners determined within seconds from online bids received.

WHAT ARE TAX CERTIFICATES?

This article originally appeared on Crestview News Bulletin: Okaloosa tax certificate sales help residents in a bind, make good investments