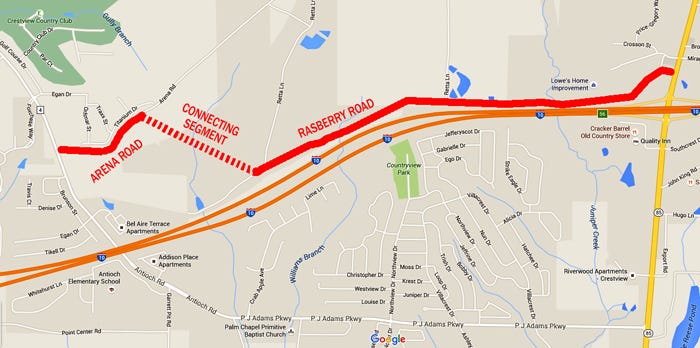

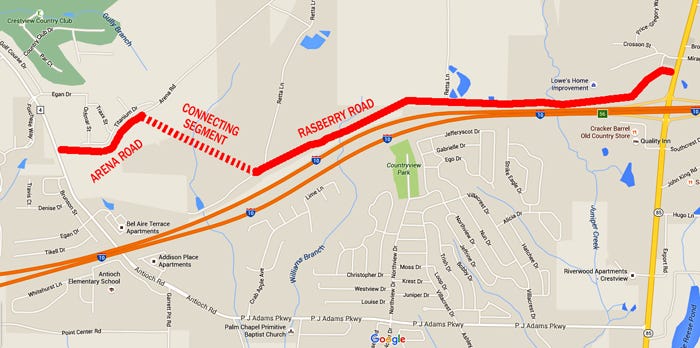

CRESTVIEW — A little-noticed city facility raises an unexpected challenge to the PJ Adams Parkway widening project, but city and county officials are searching for a solution.

Tucked back partially into woods just east of Crosspoint Crestview South church is a sanitary services lift-station, or pumping station, that sends untreated sewage to Crestview’s wastewater treatment plant about a mile and a half away.

Officials recently discovered the station partially encroaches on the parkway widening project’s right-of-way by “a few feet,” Crestview Public Works Director Wayne Steele said.

HDR Engineering's project engineers did not realize the city and Okaloosa County had not previously worked out a solution for the station when they designed the project, Steele said. An HDR spokesperson did not immediately return calls requesting comment on the issue.

Now, city and county officials must find a solution to what appears to be a costly problem.

'THERE'S REALLY NO ONE TO BLAME'

“We were surprised — and he was really surprised — that we did not know about it,” Steele said. “It was a little bit of an oversight by HDR.

"It’s a county project, so unless there’s a meeting or they release plans to us, we don’t have the privilege to sit down and study plans.”

Steele said county and city officials are immediately seeking a resolution to the matter.

“Jason Autrey has been very, very good in working with us,” Steele said. “His spirit of cooperation is very good.”

“We are absolutely working with the city of Crestview on the lift station and other utility issues,” Autrey said.

While Steele said his department had already been addressing the need to move some utility lines to accommodate the road widening — scheduled to begin this fall — the sewage lift station had not been mentioned as a problem.

“It was one of those things neither they or we realized was going to be impacted by this widening until late in the process,” Steele said. “There’s really no one to blame. I think everyone thought the lift station was going to be avoided.”

HARD TO MOVE

Steele says the city can’t move the utility; a new lift station would have to be constructed.

Further complicating matters is that it sits on the edge of federally protected wetland. That would require the Army Corps of Engineers' involvement and permitting, he said.

To relocate the station, a new site must be located, engineering drawings produced, permits sought, construction done, services disconnected from the existing station, and testing performed — and then the current station would have to be taken offline and dismantled.

Engineering and permitting could cost the city as much as $92,000, Steele said.

Actual construction and relocating utilities, including anticipated water line relocation, could top $1.2 million.

“We are going to do everything we can to accommodate the station,” Autrey said. “The reality is if we put the road out there and make them move the station, it’s going to cost the (city water and sewer) customers, which is you and me.”

Steele said city and county officials have held meetings to discuss options, while earlier this week, county and HDR engineers met at the lift station to explore solutions.

“In my meetings with Jason, we left with a very positive feeling that the city and county can work together,” Steele said.

“We want to make it the best fit for everybody,” Autrey said.

“I firmly believe we’ll find a solution for everybody.”

A sanitary services lift station on PJ Adams Parkway obstructs the road’s planned widening by “a few feet,” Crestview Public Works Director Wayne Steele says. The city and Okaloosa County Public Works officials are exploring several options.

Among them are:

●Move the lift station and reroute surrounding utility lines at a potential cost of $1.2 million, incurring delays while U.S. Army Corps of Engineers permits are completed due to surrounding wetlands

●Tweak design plans to narrow the median near the lift station so it can remain

●Run planned sidewalk over the top of the lift station so it won’t have to be moved

WHAT TO DO WITH A LIFT STATION

This article originally appeared on Crestview News Bulletin: Crestview taxpayers' $1 million PJ Adams problem