Feb 9, 2024

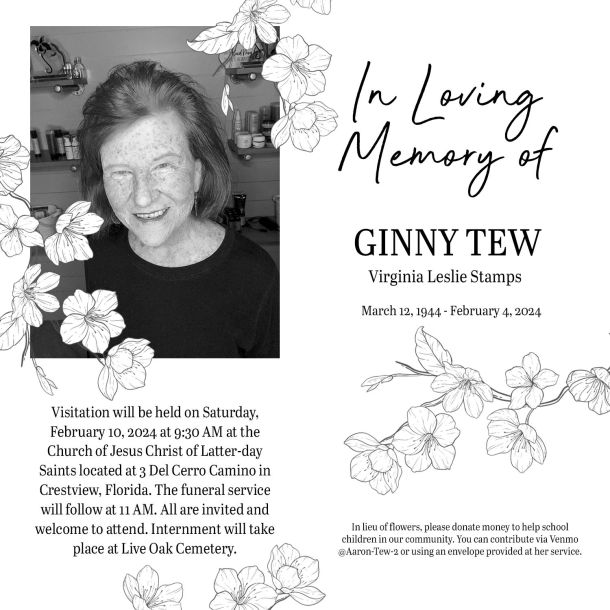

In Loving Memory of Ginny Tew

On March 12, 1944 in sunny Santa Barbara, California, Clyde and Geraldine welcomed Virginia Leslie Stamps into the world. But only telemarketers ever referred to her as Virginia. Friends and family called our redheaded spitfire of a Mom, “Ginny Tew.”

Apr 27, 2023

Earth Day lessons for investors

It’s almost Earth Day, when people around the world focus on ways of protecting and preserving the environment. And the lessons from this occasion can be applied to other areas of life — such as investing.

Apr 19, 2023

Investment ideas for business owners

By definition, business owners put a lot of their financial resources into their enterprises. But as an owner, you may need to invest in more than inventories and payroll to help achieve the future you’ve envisioned.

Apr 12, 2023

Some ‘did-you-knows’ about estate plans

If you’ve done any estate planning, or even if you’re just familiar with it, you probably know the basics — that is, a comprehensive estate plan can help you pass on assets to your family while also achieving other goals, such as designating someone to take care of your affairs if you become unable to do so.

Apr 3, 2023

Financial tips for blended families

Becoming part of a blended family can certainly be rewarding. Of course, as is the case in all families, there will be challenges, one of which is financial.

Mar 30, 2023

What goes into a retirement ‘paycheck’?

During your working years, you generally know how much money you’re bringing in, so you can budget accordingly. But once you’re retired, it’s a different story. However, with some diligence, you can put together a “paycheck” that can help you meet your income needs.

Mar 23, 2023

Time for financial ‘spring cleaning’

Now that we’ve put winter behind us — at least on the calendar — it’s time for us to think about sprucing up our homes, inside and out. But it also may be time to do some financial spring cleaning.

Mar 13, 2023

Should investors ‘go it alone’?

If you’re going to enjoy a comfortable retirement, you should know, among other things, how much money you’ll need.

And you may have a much better chance of knowing this if you get some professional help.

Mar 6, 2023

Have you built an emergency fund?

Many people make financial New Year’s resolutions, such as reducing their debts or contributing more to their retirement accounts — both of which are certainly worthy goals.

But among those who planned to make a financial resolution for 2023, the primary reason was the desire to build an emergency savings fund, according to a December 2022 study by research firm Morning Consult.

Mar 2, 2023

Can you plan for an unplanned retirement?

Many people plan to take an early retirement, so when that day arrives, they’re ready for it.

But what if you were to face an unplanned retirement? Would you be prepared to deal with the financial issues?