What health insurance can — and can't — buy

Medical insurance is getting lots of attention right now in the media, and there are many viewpoints.

I shared some of mine a few weeks ago about both doctors and hospitals posting their prices for service. I think a free-market fee for services would work in many instances, with a high-deductible insurance plan for a catastrophic occurrence such as cancer.

I enjoyed the article in the Crestview News Bulletin about Dr. J.D. Bailey opening a medical practice here in Crestview, where one pays a membership fee and belongs to this practice.

Dr. Bailey is limiting the number of patients, which should be great for his patients. I love innovative solutions, and this is a great idea. One would have access to medical care when it is needed, and wouldn't have to wait for the insurance company to approve it or wait weeks for an appointment.

The other end of the fee-for-services spectrum is the idea that government should provide insurance for everyone, a system that is financially and logistically unworkable.

An insurance card doesn't mean one will have access to health care, especially if we don't dramatically increase medical professionals.

We have a shortage of medical professionals now, and as more doctors and nurses are retiring, they aren't necessarily being replaced.

Americans, as a nation, are kind, and although we would like to see those with pre-existing conditions get insurance for the same cost as those who are healthy, financially, it can't work.

Would a car insurance company insure a safe, accident-free driver for the same price as a driver that has had three or four accidents?

No, so we need to use our financial sense, not just our emotions.

Another big issue is people buying insurance after they are sick. Would you try to buy auto insurance after you had an accident and expect the insurance to pay for a brand, new car?

We, as consumers, need to take responsibility for our health, not wait until we are ill to exercise and eat right.

We need to allow families to choose insurance or not and allow them to make their own health care decisions, even if we disagree with their decision.

This is what freedom is all about.

Janice Lynn Crose, a former accountant, lives in Crestview with her husband, Jim; her two rescue collies, Shane and Jasmine; and two cats, Kathryn and Prince Valiant.

This article originally appeared on Crestview News Bulletin: What health insurance can — and can't — buy

![The book, "Mississippi Blood," by Greg Iles, will soon be available for check-out at the Crestview Public Library. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-4a8ab6ac-e87c-5878-e053-0100007fa9b8-09812593.jpeg)

![Yvonne Shanklin is an Edward Jones financial adviser. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-4a8ab6ac-e874-5878-e053-0100007fa9b8-78e6981f.jpeg)

![An adult azalea lace bug and excrement are pictured on an azalea leaf. [James Castner | University of Florida]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-4a8ab6ac-e870-5878-e053-0100007fa9b8-9b2d33ec.jpeg)

![The Rev. Mark Broadhead is pastor at Laurel Hill Presbyterian Church and First Presbyterian Church of Crestview. [File photos | News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-498783e6-99fe-75eb-e053-0100007f4706-201aba9b.jpeg)

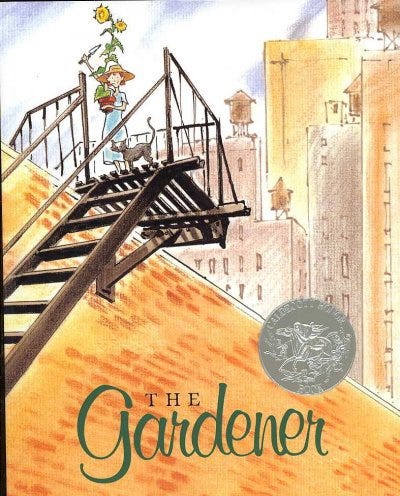

!["The Gardener" by Sarah Stewart is about a girl who gets sent to live with her uncle in the city during the Great Depression. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-49877b25-3dee-75ed-e053-0100007f30e0-dd612dc9.jpeg)

![Yvonne Shanklin is an Edward Jones financial adviser. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-49877b25-3d3f-75ed-e053-0100007f30e0-791c6079.jpeg)