HAPPENINGS: More adventures from California

Trains have come a long way from the Old West days.

While I was in California, I had a grand adventure taking the Amtrak Surfliner from Anaheim to San Diego. It was roomy, and the padded seats were a nice width.

The regular car, which I rode in, had large windows so you could see along the coastline. There is a business class, which looks like a mobile office; it has tables upon which to work, free WiFi and better lighting, along with complimentary snacks. The food car had nice tables to relax around; coffee, tea and other beverages; and sandwiches, salads and snacks.

I think it took about 30 minutes longer to take the train than to drive, but it was much more enjoyable.

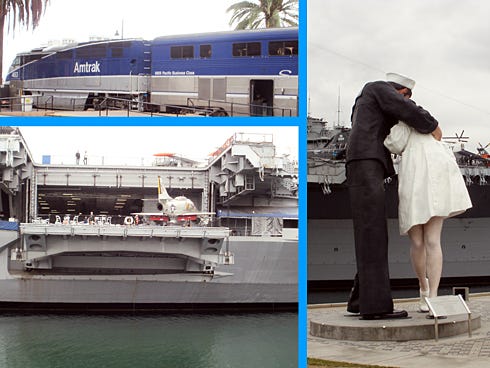

Once we got to San Diego, Jim, my husband, and I went to Tuna Harbor Park to see the aircraft carrier, USS Midway in the San Diego bay, along with the Bob Hope Memorial. Also in the park is the 25-foot "Unconditional Surrender" statue. (That's the World War II sailor kissing the nurse at the end of the war.)

We then went to Seaport Village, of which I had fond memories — but alas, no longer. We were there about 75 minutes and it cost $16 to get out of the parking lot; no attendant, just a credit card machine. I used to love the old carousel and the charm, but nothing is worth that amount of money to park. Shame on the city of San Diego for taking advantage of tourists!

On a positive note, California excels at Mexican food. We ate several times at Fonda Don Chon, which was always extremely busy. Some of the best Mexican food I have ever tasted. They had a wonderful buffet at lunch with all-you-can-eat guacamole that was scrumptious. I told the owner he would make a killing here — the food was that outstanding.

Do you have any favorite restaurants? What is your favorite type of food? Share your thoughts about favorite local dishes, and see photos from Janice's trip, at www.crestviewbulletin.com/lifestyle.

Janice Lynn Crose lives in Crestview with her husband, Jim; her brother, Robb; her two rescue collies, Shane and Jasmine; and two cats, Kathryn and Prince Valiant.

Email listings of upcoming events to NorthOkaloosaHappenings@gmail.com.

This article originally appeared on Crestview News Bulletin: HAPPENINGS: More adventures from California