Make the most of your summer vacation

Summer vacation for many families is almost over. In just a few short weeks, school will be back in session for another year.

Did your family go on a memorable destination vacation, such as a cruise, overseas, or to a theme park; or did you stay close to home and take day and weekend trips to our wonderful beaches and parks? We are fortunate to live in such a beautiful area where we can drive short distances to terrific places of interest.

How much reading did you and your family accomplish? Did you finally read that special book you've been wanting to read? We are so fortunate that we have such a well-stocked library in Crestview with such a helpful staff. They are always a pleasure to be around.

Was there a list of partially finished projects you wanted to tackle this summer? Like me, did you try and catch up on your hobbies, finish up some sewing projects or scrapbooking? Many of you spend hours in your yards and gardens — did you accomplish what you set out to do?

While I love plants in my garden, I seem to do better with potted plants on my porch. I have some beautiful hibiscus plants that are happily blooming, even in this heat. My begonias are still in bloom, although I need to transplant them to a larger pot and the petunias haven't done well with all the rain we have had. I think I need to buy some new ones and put them on the porch where they won't get so much rain.

What are you proud of that you completed this summer? Perhaps it is a room that you redecorated, painted or rearranged. Perhaps you got a closet or cupboard cleared out and organized.

There are always many tasks on my to-do list. While I didn't finish everything, there were a few items I checked off the list. I read the book of Romans in the Bible in anticipation of my fall bible study. I rehearsed music that I will be singing for church, and picked out some new pieces to learn.

I also began two new books on the history of our country and hope to finish them soon. I have closets that need to be cleaned out and organized. I hope I can finish them before September.

Another summer goal area residents may have is purchasing items for the upcoming school year. The back-to-school sales tax holiday is the weekend of Aug. 4-6.

Clothing and shoes that are less than $100 each will be sales tax free, as well as school supplies that are less than $15 each and computers that are less than $750. If you need to invest in a new computer, this would be the weekend to purchase. Start making your lists now, so that you can take advantage of the savings.

Make the most of these final days before school is back in session and your schedule gets crowded.

Janice Lynn Crose, a former accountant, lives in Crestview with her husband, Jim; her two rescue collies, Shane and Jasmine; and two cats, Kathryn and Prince Valiant.

This article originally appeared on Crestview News Bulletin: Make the most of your summer vacation

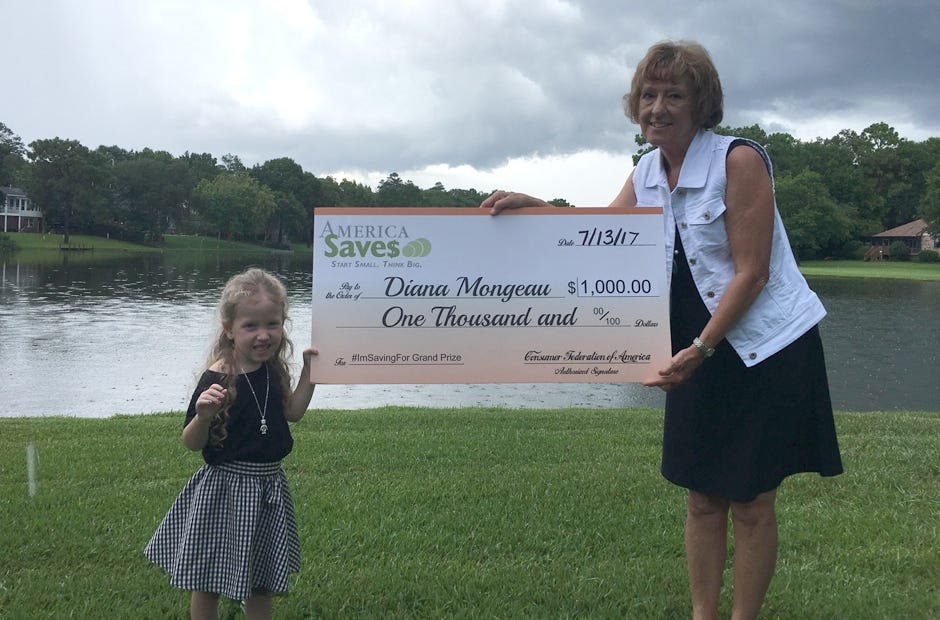

![Jill Breslawski, left, presents the Okaloosa Saves #imsavingfor grand prize, a $1,000 check, to Diana Mongeau of Niceville July 13. Mongeau was accompanied by her granddaughter, Jazzy. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-54d8be71-b612-593c-e053-0100007f8235-c4120ade.jpeg)

![Yvonne Shanklin is an Edward Jones financial adviser. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-54d8c310-65c3-5944-e053-0100007fc1bc-a616a0cf.jpeg)

![The Rev. Mark Broadhead is pastor at Laurel Hill Presbyterian Church and First Presbyterian Church of Crestview. [File photos | News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-531eb044-3cea-79e6-e053-0100007ff08e-57562068.jpeg)

![Master Naturalist and citizen scientist Diana Moore, left, assists with outreach at a local event. [Laura Tiu | News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-531eb044-2e92-79e6-e053-0100007ff08e-78a733cd.jpeg)

![Yvonne Shanklin is an Edward Jones financial adviser. [Special to the News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-531eb044-2e84-79e6-e053-0100007ff08e-78f85574.jpeg)

![The Rev. Mark Broadhead is pastor at Laurel Hill Presbyterian Church and First Presbyterian Church of Crestview. [File photos | News Bulletin]](https://crestviewbulletin.com/wp-content/uploads/2022/01/ghows-DA-531eb044-2730-79e6-e053-0100007ff08e-66cdcb89.jpeg)